- Reports actual, audited financial data for the prior school year.

- All LEAs report data for the PEIMS Mid-Year submission.

- Any audit corrections must have been made in the LEA’s records.

- LEAs must report records related to detailed revenue, fund balance, and expenditure accounts.

- Fund balance accounts (codes 3XXX) should show the post-closing fund balances on August 31 of the prior year, with all audit adjustments posted.

- The PEIMS data collection format reflects the mandated minimum account code structure in the Financial Accountability System Resource Guide (FASRG).

*NOTE- Actual audited balances for a school year are submitted to TEA the following school year in the Mid-Year PEIMS submission.

Example: all balances for the 22-23 school year are reported to TEA in January 2024, during the 23-24 school year. Therefore, updated reporting using 22-23 data can only be generated by the LEA once Mid-Year PEIMS 23-24 is loaded.

| TEA 23-24 PEIMS Mid-Year Submission (Sub 2) Timeline for 22-23 Data | |

|---|---|

| PEIMS Mid-Year submission ready for users to promote data | November 13, 2023 |

| TSDS PEIMS Mid-Year ready for users to complete, approve, and accept submissions | December 18, 2023 |

| PEIMS Mid-Year first submission due date for LEAs and ESCs | January 25, 2024 |

| PEIMS Mid-Year resubmission due date for LEAs and ESCs | February 8, 2024 |

| PEIMS Mid-Year data available to customers | February 29, 2024 |

OnDataSuite opened 23-24 MidYear Submission in the File Center with TSDS Rules(Edit) and reporting in September, 2023.

- Mid-Year PEIMS files in OnDataSuite reporting are associated with the year the data is reported (actual 2022-2023 data) as opposed to the year PEIMS collects (2023-2024).

- All reports reflect the use of the Mid-Year PEIMS data accurately upon the TEA PEIMS collections schedule.

- The File Center in ODS will reflect the TSDS PEIMS year the file was collected by TEA. Ex: Acutal 2021-2022 is a MidYear 22-23 file.

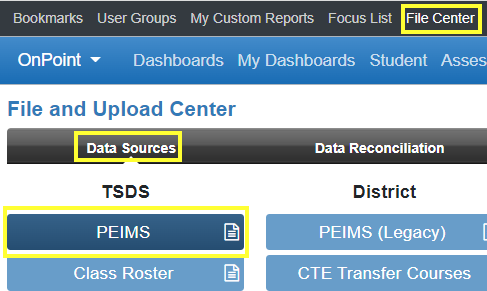

- Select the PEIMS blue button

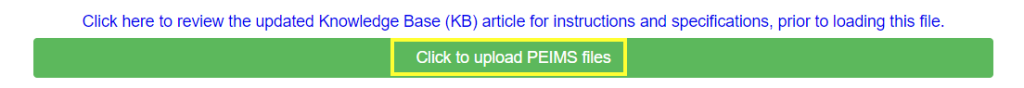

- Use the green “Click to upload PEIMS files” tab to browse to the MidYear TSDS PEIMS interchange files created by the Business Information System (BIS)/Enterprise Resource Planning(ERP).

Browse to either a zipped (not password protected) or unzipped file.

- Make sure the file type is “All” at the bottom right of the browse screen.

- Select ALL interchange files to be loaded at once.

- The order does NOT matter.

- For more details:

- Reference Knowledge Base article Loading TSDS – PEIMS – District Level

- Reference OnDataSuite File Center Training

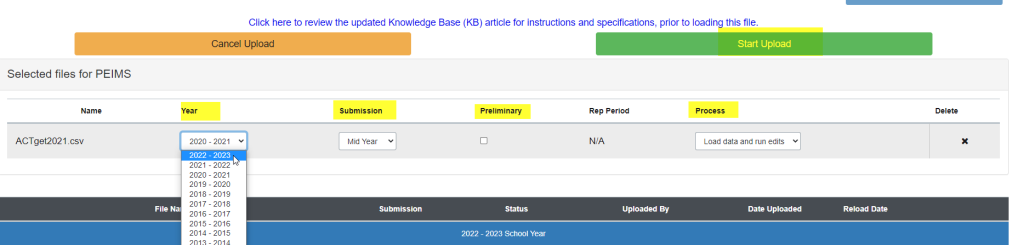

- Ensure the correct year/submission is selected (this is the TEA PEIMS submission year – ex. Actual 21-22 submitted Midyear 22-23)

- Select “Preliminary” if this is NOT the final file going to TEA

- Select Process – “Load data and run edits” – This option will update any reports based upon MidYear PEIMS data and run the TSDS Rules/Edits.

- Select green button Start Upload to process the file.

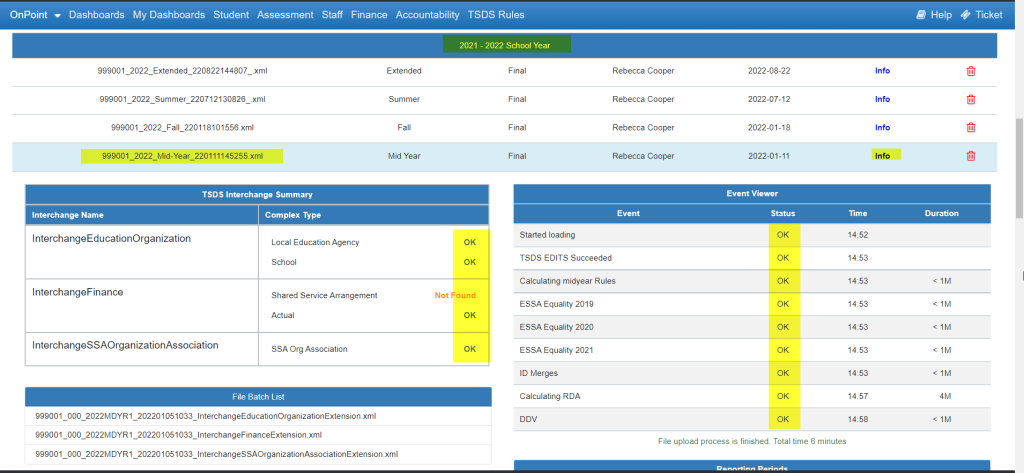

File Review – Scroll toward the bottom of the screen to verify Mid Year files for desired year(s) have been loaded.

- Click on the file after it is loaded to ensure all interchanges loaded.

- NOTE: Keeping data current is key to accurate reports so please contact your OnDataSuite Administrator if a “fresh” file needs to be loaded.

NOTE: Subsequent file uploads will completely wipe and replace all files currently loaded for this submission/year.

REMINDER: The FIle Center will reflect the Year TEA Collects the Data. For MidYear Submissions – All ODS reporting in Finance will reflect the Year the Data Represents.